MirrorEX

Regulatory-Grade Custody

Full Access to Exchange Liquidity

Mirror your assets. Trade anywhere.

Custody stays with OSL.

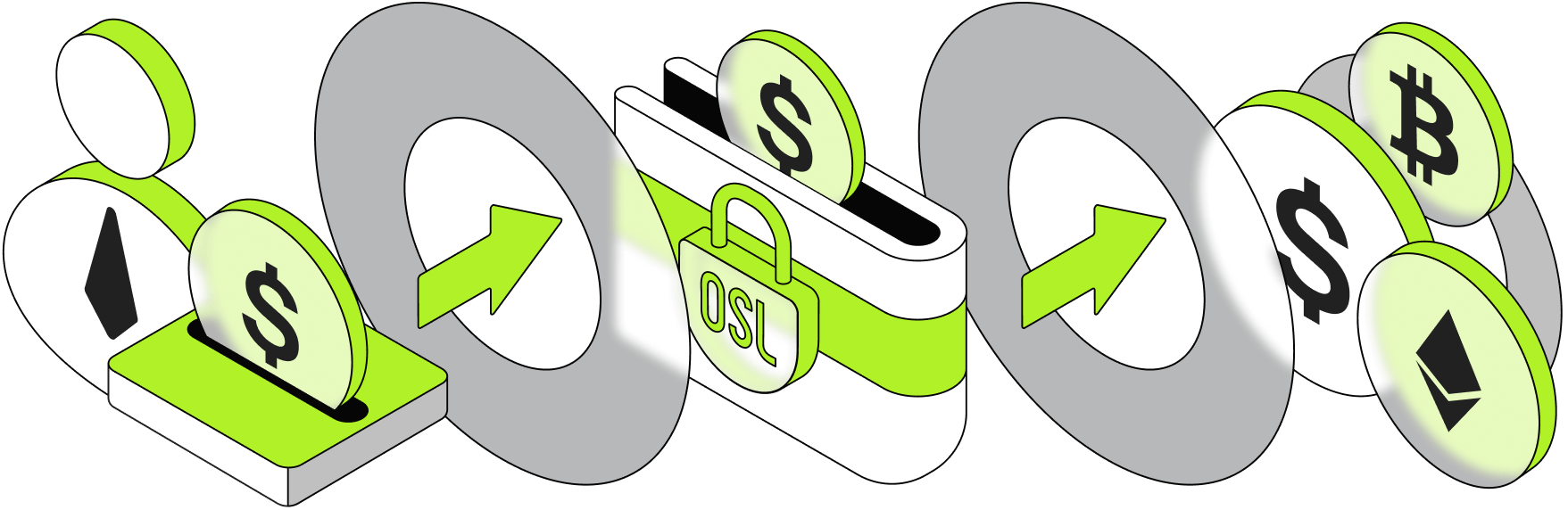

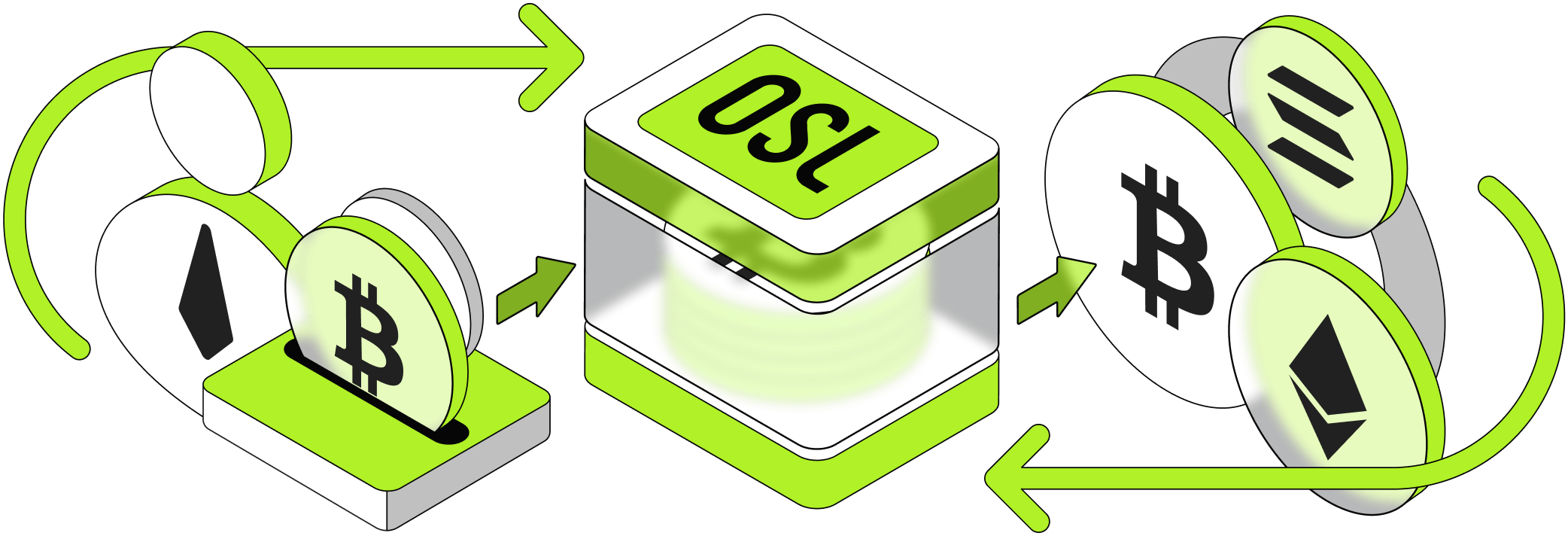

MirrorEX creates a secure, 1:1 mirrored balance on partnered exchanges, allowing institutions to deploy capital into active trading without ever moving the underlying assets out of OSL custody.

All settlement flows are configurable between OSL, the client, and the trading venue — with optional real-time on-chain settlement to ensure transparency and risk control.

Instant Asset Locking

MirrorEX lets institutions lock assets and mirror them to exchanges almost instantly—far faster than traditional on-chain deposits—enabling immediate trading readiness.

Automated Settlement

Settlement flows, including fee management and balance updates, are executed automatically with full transparency, ensuring clients remain informed throughout the entire process.

Cold-Wallet Segregation

Client assets are safeguarded in fully segregated offline cold wallets managed by OSL, supported by 24/7 operational monitoring and secure custodial procedures.

Regulated Custody & Insurance

Backed by multi-jurisdictional regulatory licences, MirrorEX offers compliant digital asset custody with the option to add insurance coverage for enhanced protection.